Interac e-Transfer†

Sending, requesting and receiving money directly from one bank account to another is easy - thanks to Interac e-Transfer†!

What do I need?

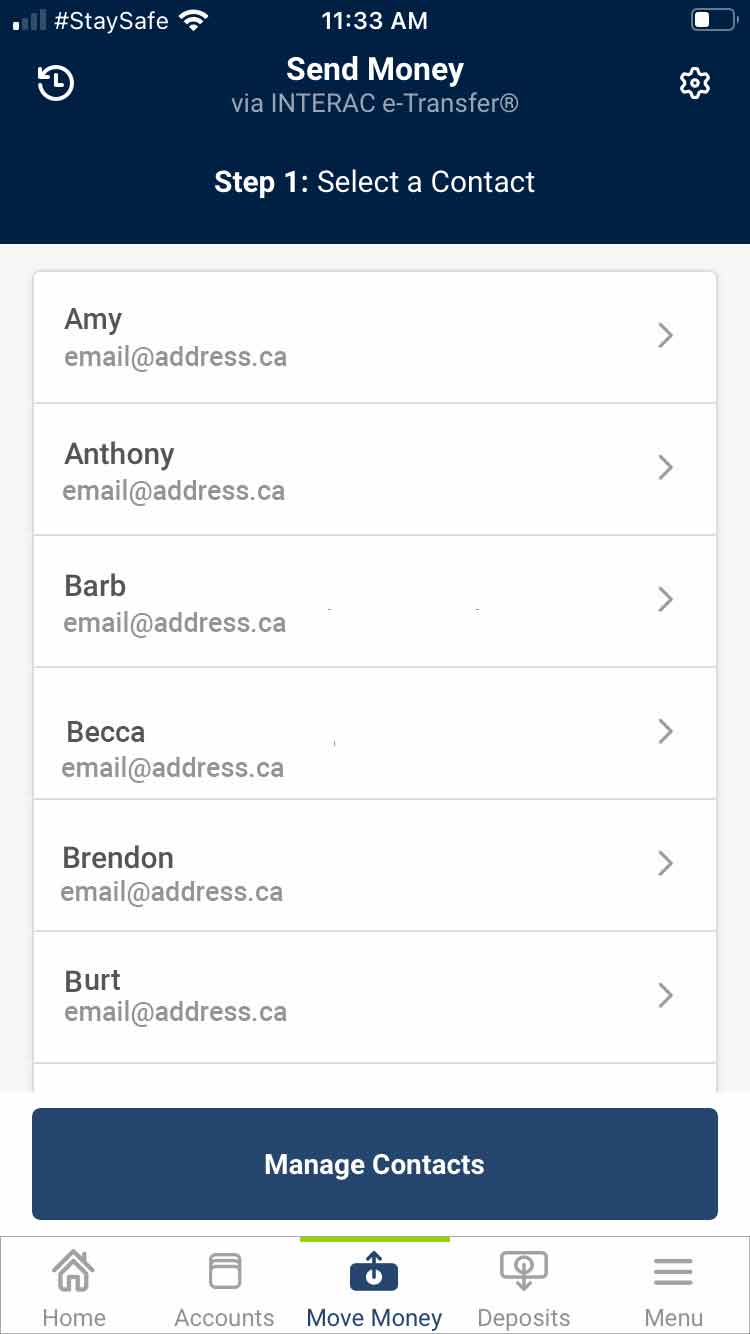

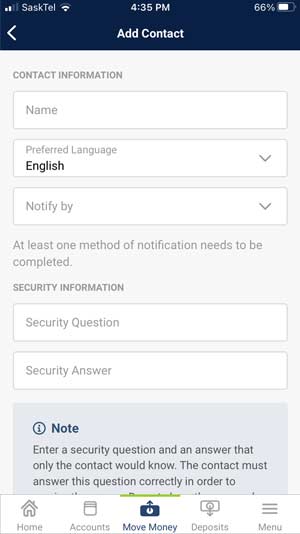

All you need is access to RF online banking or the RF Mobile app and you can send or request money to anyone with an email address or mobile phone number and a bank account in Canada.

Is it secure?

Personal information is never shared so it’s safe, reliable and so convenient!

Receive transfers even faster!

Autodeposit allows you to automatically deposit incoming transfers into an account of your choice without having to manually accept and answer the security question. No more waiting for emails and texts! Learn how to sign up for Autodeposit in the FAQ section below.

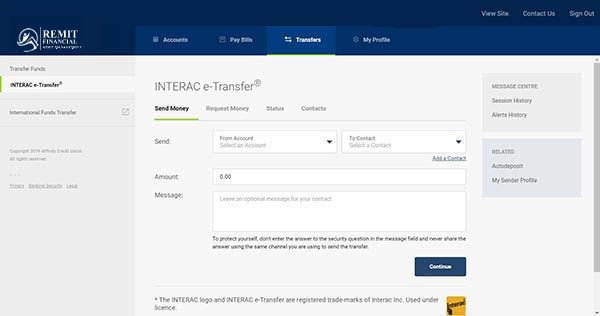

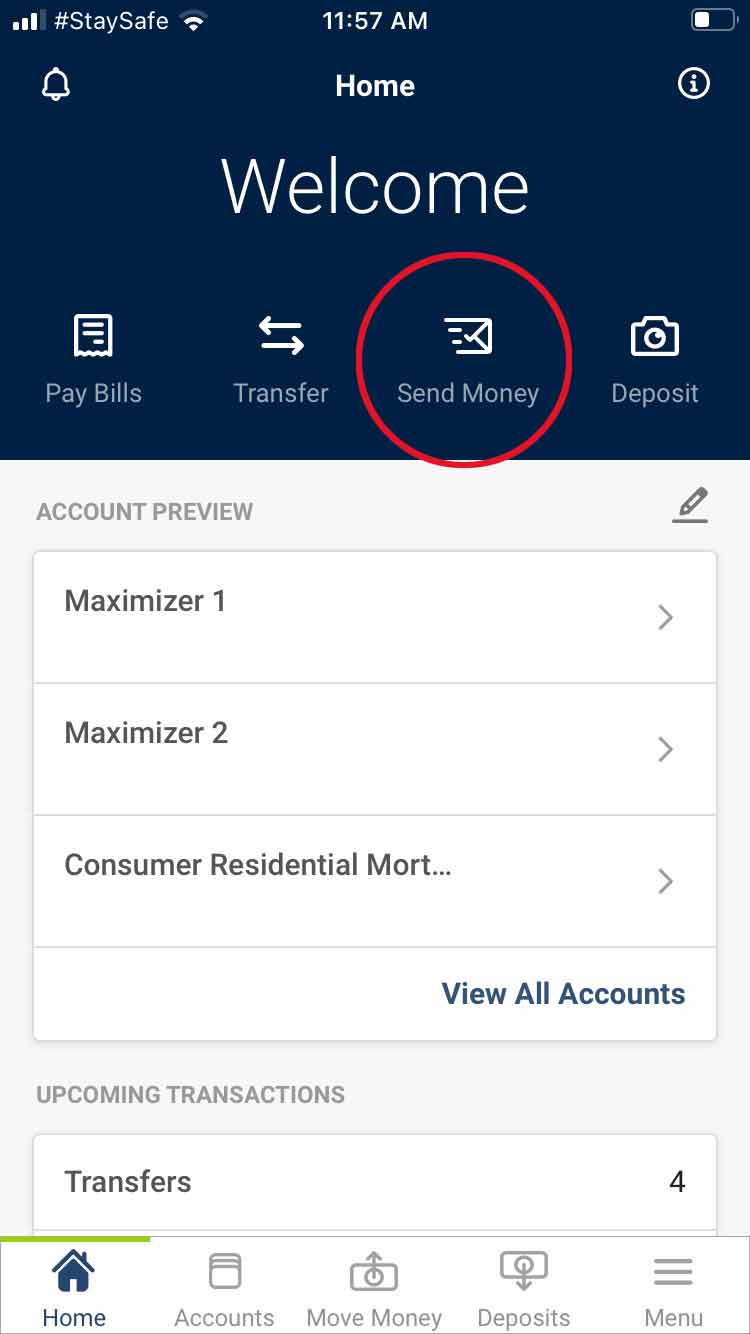

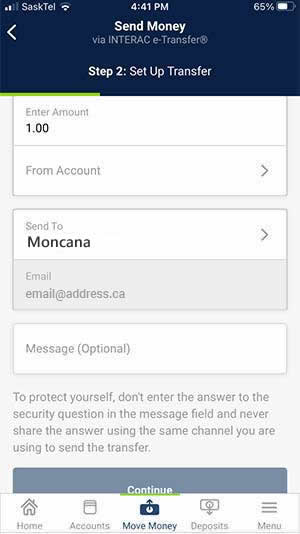

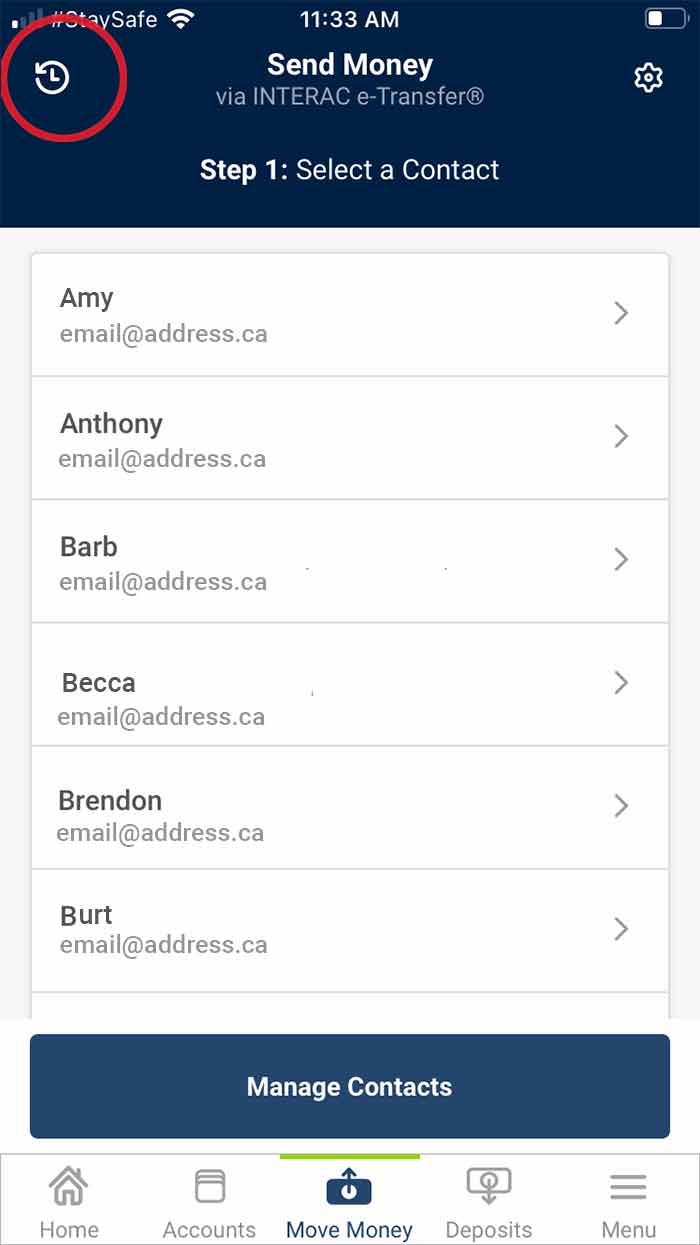

Where do I start?

Send and Receive Limits

| Send | ||

|---|---|---|

| Per transaction | $3,000 | to max. weekly limit |

| Per day | $10,000 | to max. weekly limit |

| Weekly Limit | $10,000 | 7 days inclusive |

| Monthly Limit | $20,000 | 30 days inclusive |

| Receive | ||

|---|---|---|

| Per transaction | $25,000 |

Effective July 8, 2021 there is no longer a restriction on the cumulative daily, seven-day, or 30-day rolling periods.

Service Fees

It's free to send an Interac e-Transfer† from your Unlimited, Youth, Student or 65+ chequing account.

Your first two e-Transfer† transactions per month are free with the Value Chequing. Beyond that there’s a $1 fee per e-Transfer†. The $1 fee applies to all Interac e-Transfer† transactions on the Pay-as-you-go chequing. They also count as an electronic debit so you may be charged an additional fee depending on the type of account you have and how many transactions you’ve completed that month.

As for our business accounts, we offer free unlimited e-Transfer† transactions with the Business Select chequing account. Our Business Enhanced and Business Basic chequing accounts give five free e-Transfer† transactions per month and beyond that there’s a $1 fee per e-Transfer†. The $1 fee applies to all e-Transfer† transactions from your Business Savings account.

Receiving Interac e-Transfer† transactions are always free for the recipient!

Looking to learn more? Find it here:

†Interac e-Transfer is a registered trademark of Interac Inc. Used under licence.